Vitis Quantitative Finance Library

- Design Tools

- Vitis Unified Software Platform

- Vitis Libraries

- Vitis Quantitative Finance Library

For Financial Analytics, time-to-insight is key to predicting risks, making informed business decisions for clients, and providing differentiated financial services that sets you apart from your competition. AMD platforms provide the adaptability, flexibility, and much needed computational power to significantly accelerate your time-to-insight.

Vitis™ Quantitative Finance library offers optimized functions to build accelerated computational solutions for financial workloads, such as options-pricing, modeling, trading, evaluation, and risk management.

The library is designed to provide 3 levels of abstraction and flexibility to application, software and hardware developers. Library APIs are pre-compiled accelerators, that can be directly called in your host application. Library kernels and primitives can be compiled as standalone accelerators or combined with other Vitis accelerated-libraries (like Math, Statistics, Linear Algebra) and AMD Partner libraries to accelerate your custom end-to-end processing pipeline.

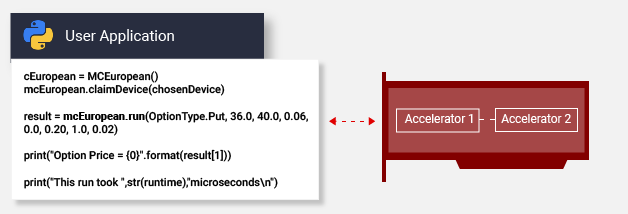

Vitis Quantitative Finance APIs (L3) can be called directly in your C, C++, or Python host applications and are ideal for rapid prototyping and quick evaluation of the performance benefits AMD can bring to your quantitative finance workloads. Using these pre-built accelerators requires no prior hardware design experience or learning curve. Examples include pricing models like Heston Finite Difference, Monte Carlo Black Scholes American, and European models, and this list continues to grow.

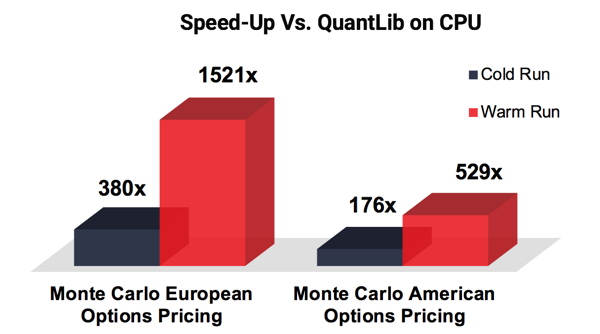

Performance Benchmark

- CPU: 2 Intel® Xeon® CPU E5-2690 v4 @3.20GHz, 8 cores per processor and 2 threads per core.

- AMD: Vitis Quantitative Finance Library v1.0 running on 1 Alveo U250

- Cold Run: Pricing Engine starts up in response to a request.

- Warm Run: Pricing Engine is already running, with sufficient memory allocated to handle the request

| Monte Carlo European Options Pricing | ||

|---|---|---|

| Cold Run | Warm Run | |

| QuantLib | 20.155 ms | 20.155 ms |

| Vitis Quantitative Finance Library | 0.053 ms | 0.01325 ms |

| Speed-Up | 380X | 1521X |

| Monte Carlo American Options Pricing | ||

|---|---|---|

| Cold Run | Warm Run | |

| QuantLib | 1038.105 ms | 1038.105 ms |

| Vitis Quantitative Finance Library | 5.87 ms | 1.96 ms |

| Speed-Up | 176X | 529X |